You Still Have Options – Act Fast Before Clean Energy Tax Incentives Disappear

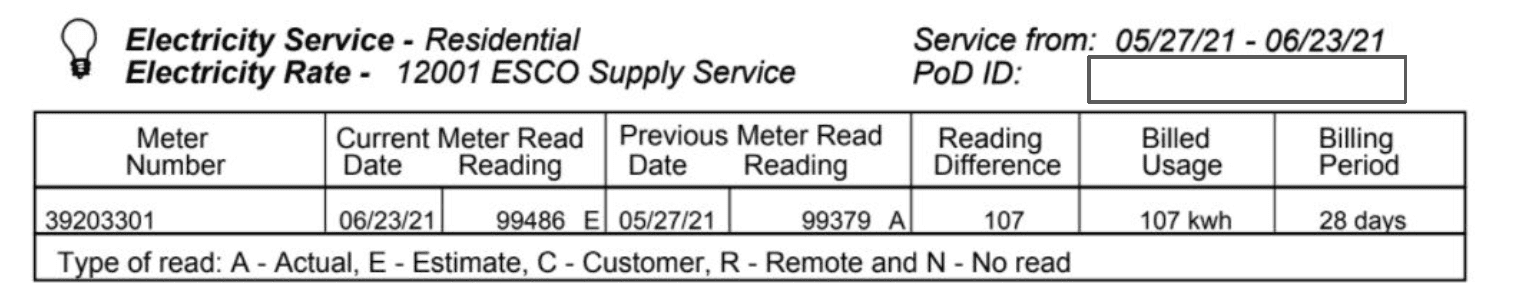

H.R. 1, more commonly known as the “One Big Beautiful Bill” or “OBBB” was passed by Congress in July and signed into law by the President. It enacts sweeping cuts to the federal energy tax credits that make clean energy projects more affordable. Many of these tax credits will now expire by the end of 2025 and some even sooner. Here are the specifics:

Solar, Battery Storage, and Geothermal Heat Pump Incentives: The 30% federal tax credit for these technologies and products will be eliminated for systems that haven’t been fully installed by December 31, 2025.

Electric Vehicle Incentives: The tax credit for new EVs will sunset on September 30, 2025. Same for the $4,000 tax credit for used EVs.

Home Energy Efficiency and Weatherization: The $1,200 tax credit for energy audits, insulation, energy efficient windows, skylights, and doors, plus the $2,000 credit for air source heat pumps and heat pump water heaters will all expire at the end of 2025. (Thank you Bedford 2023 Energy Coach Bob Fischman for this good data.)

For a full list of expiring tax credits, visit Rewiring America.

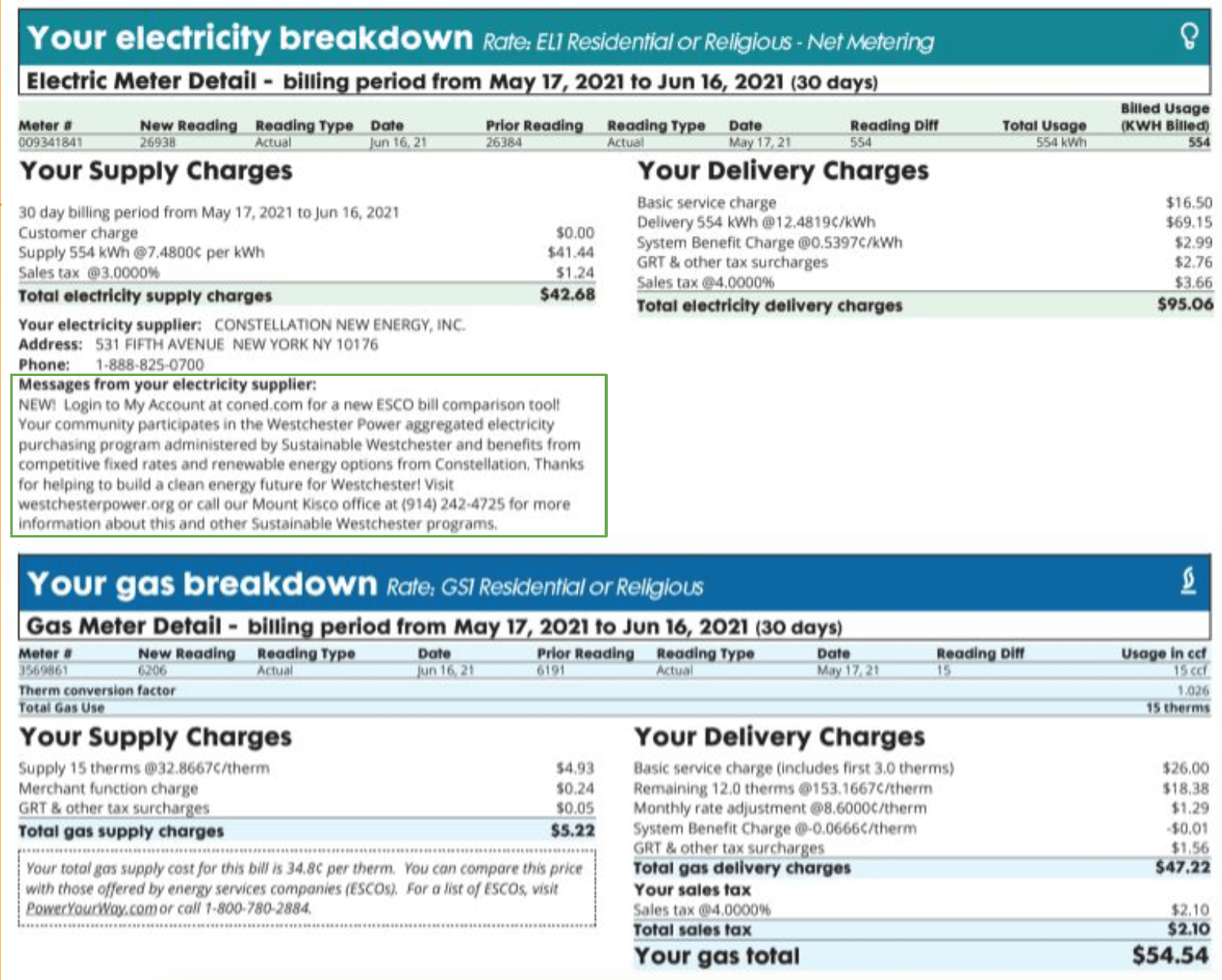

There’s no sugar-coating the financial and environmental impact of the OBBB. These disappearing credits have delivered big savings here in Westchester. Based on calculations by Leo Wiegman, Solar Programs Director at Sustainable Westchester, the average Westchester household installing solar claimed a federal tax credit of approximately $10,800! And that doesn’t even include the other technologies and products listed above.

But take heart! Residents still have a path forward to make home energy improvements. Here are three important tips:

First, act fast. The federal incentives are going, but not yet gone, so by moving forward quickly, you can still take advantage of sunsetting credits. Keep in mind that many projects require lead time for design, permitting, utility approvals, and installation. Furthermore, demand for these projects is expected to rise quickly as the deadline approaches. Start right away to get the best possible deal.

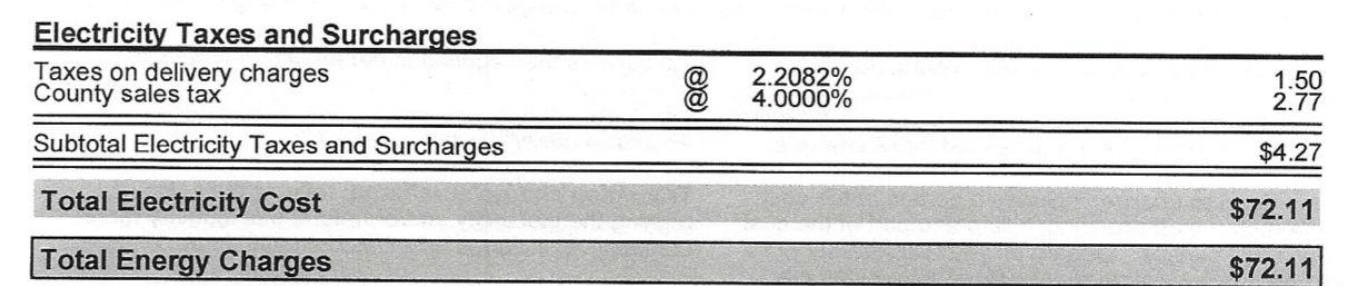

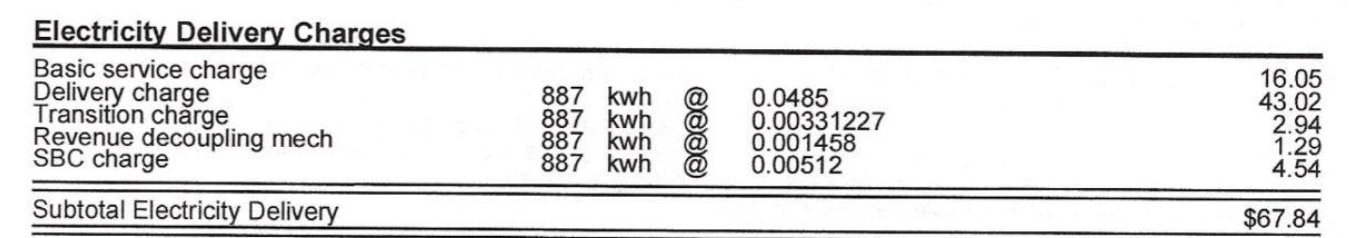

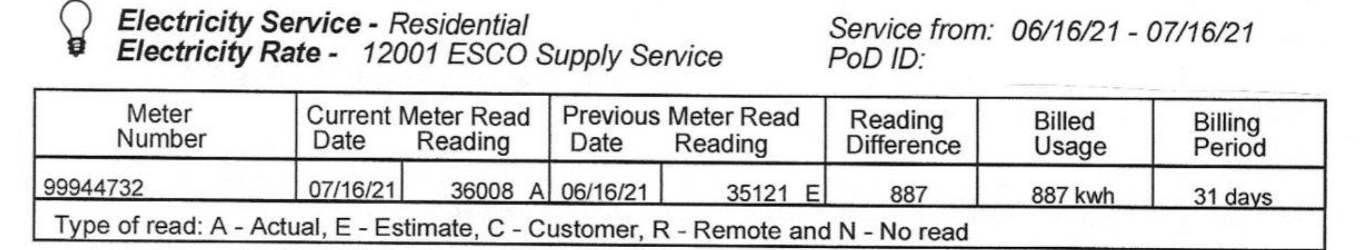

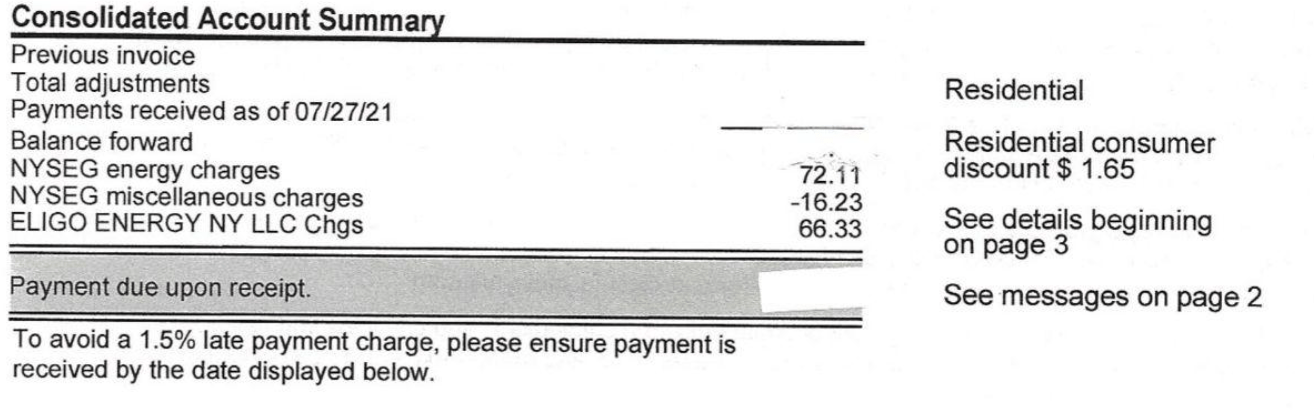

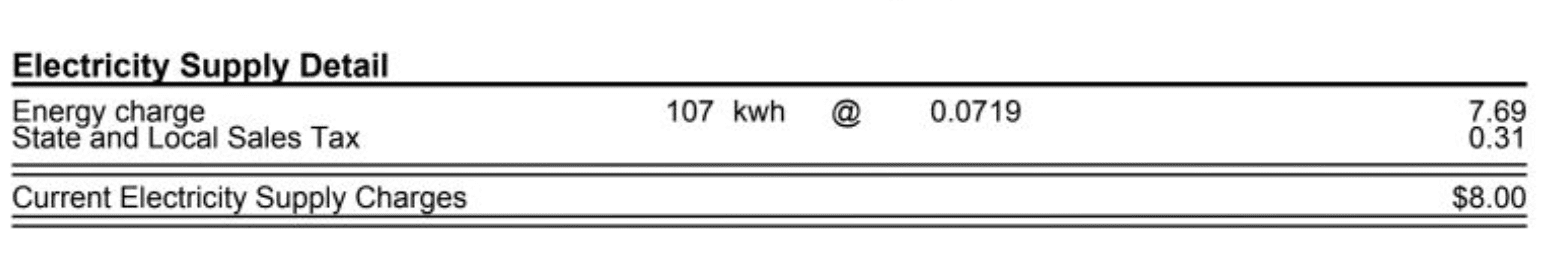

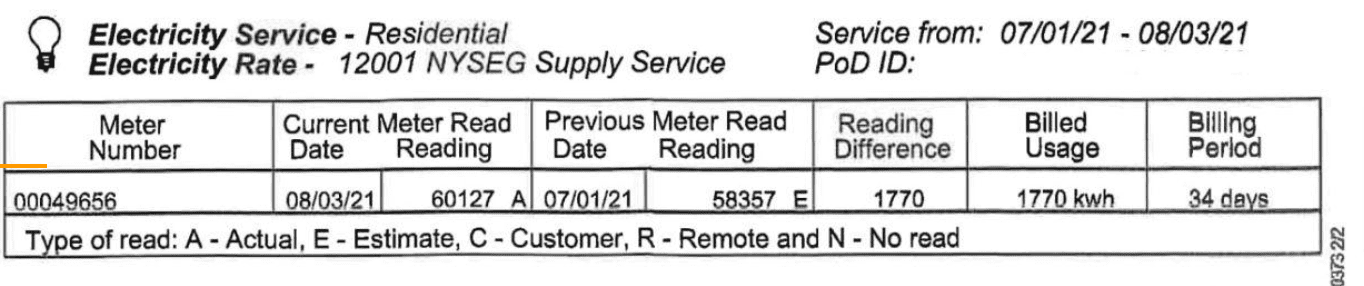

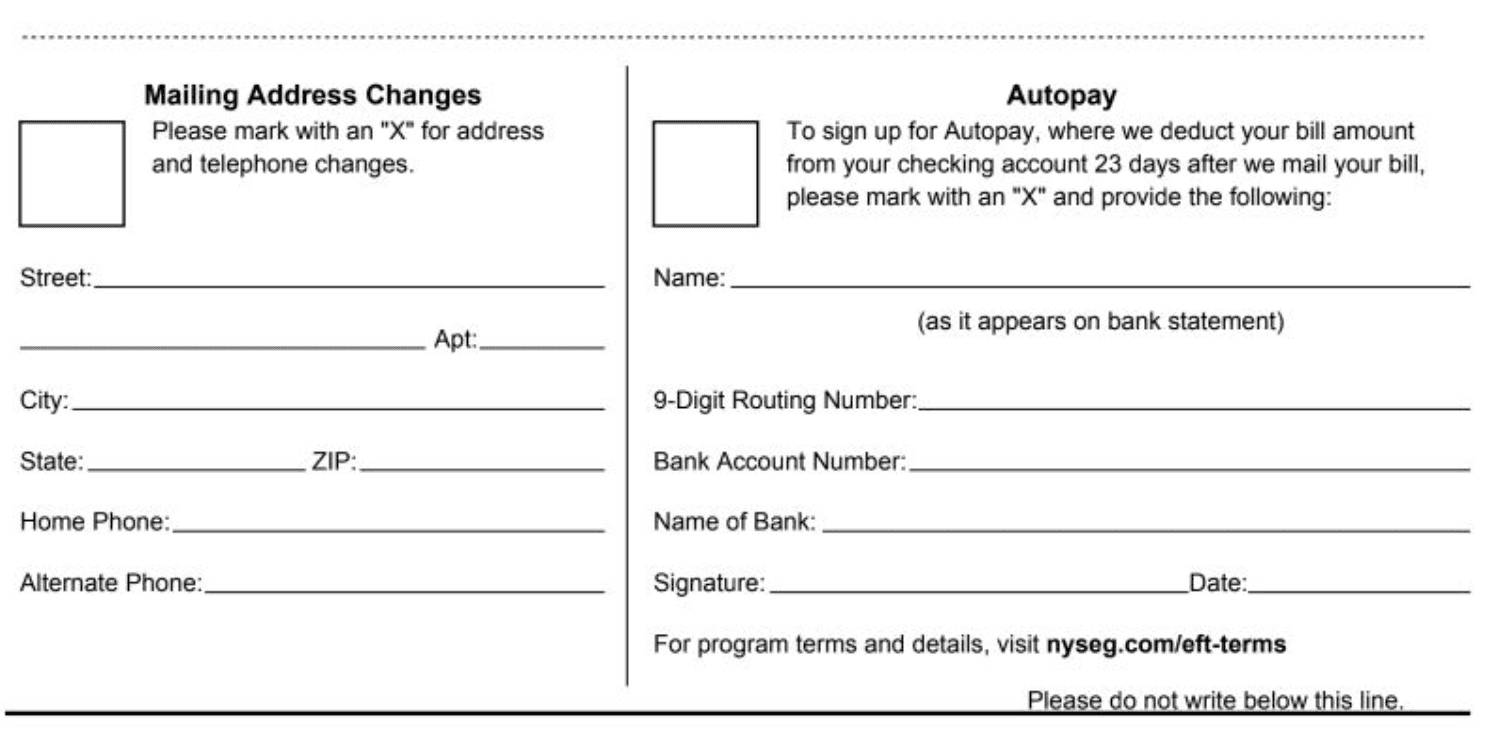

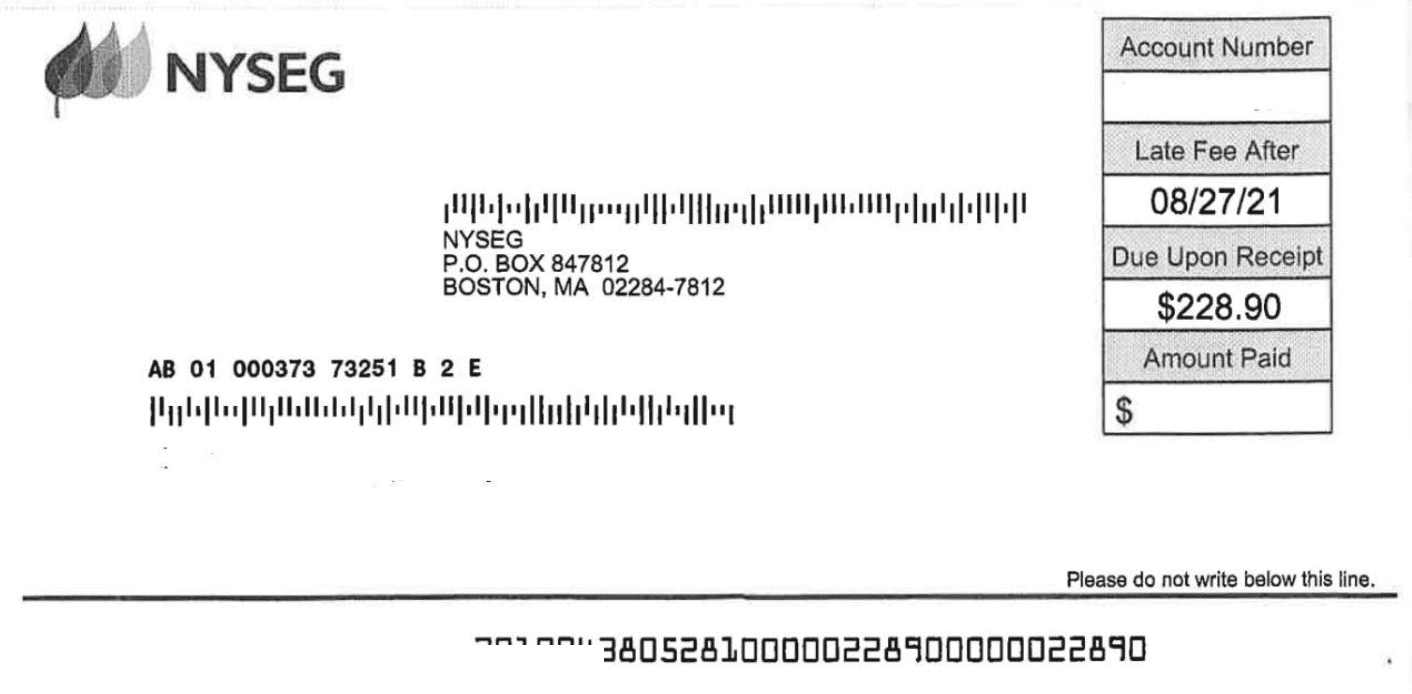

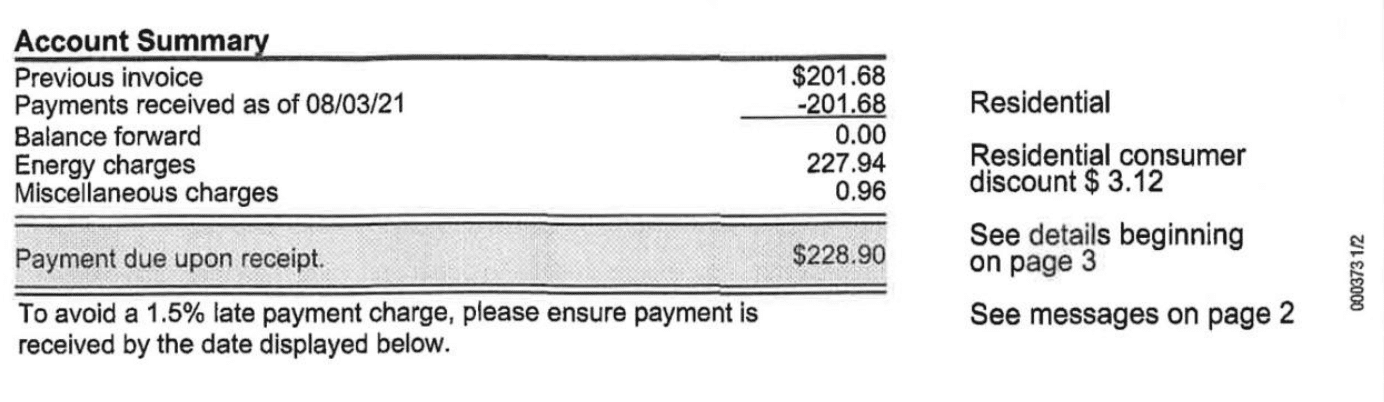

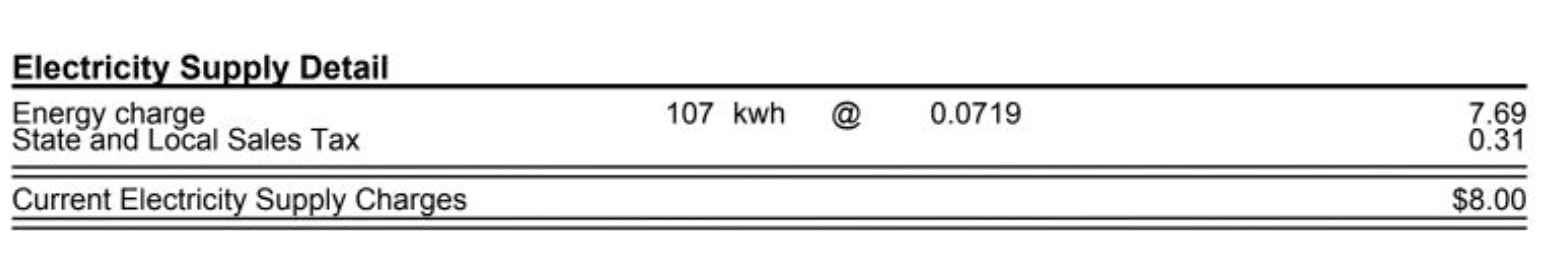

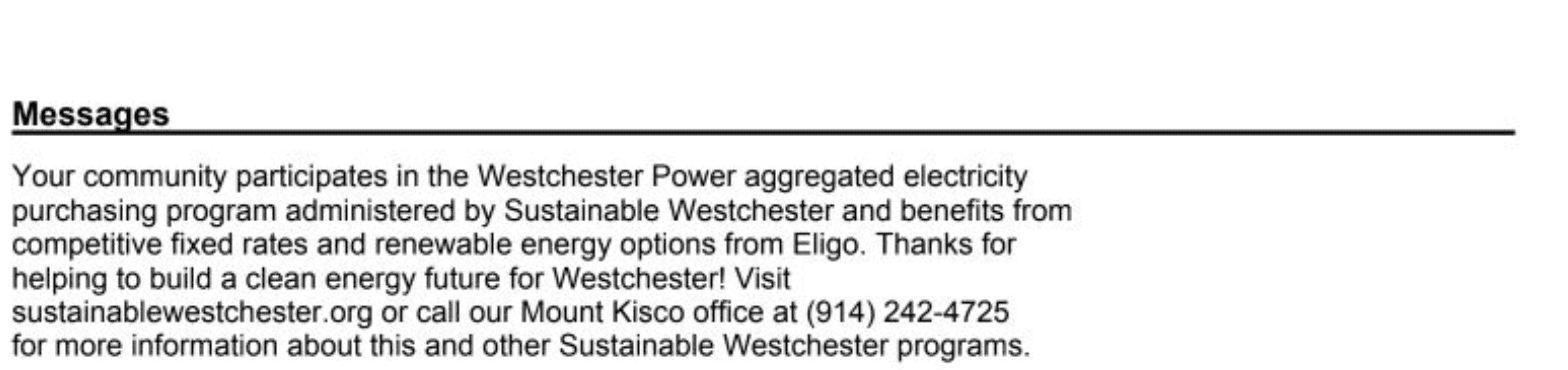

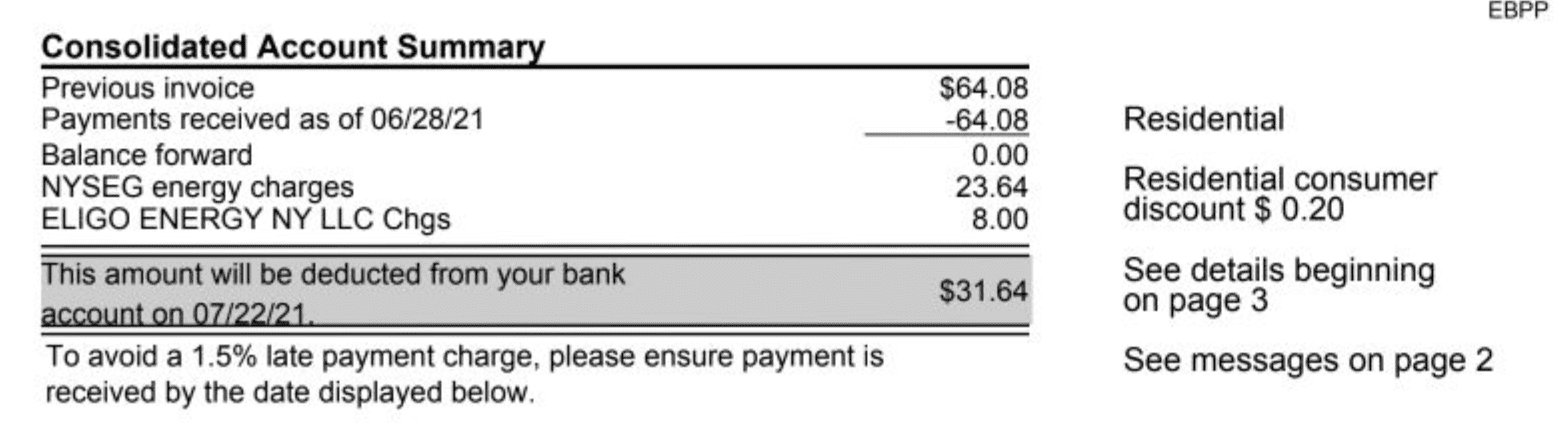

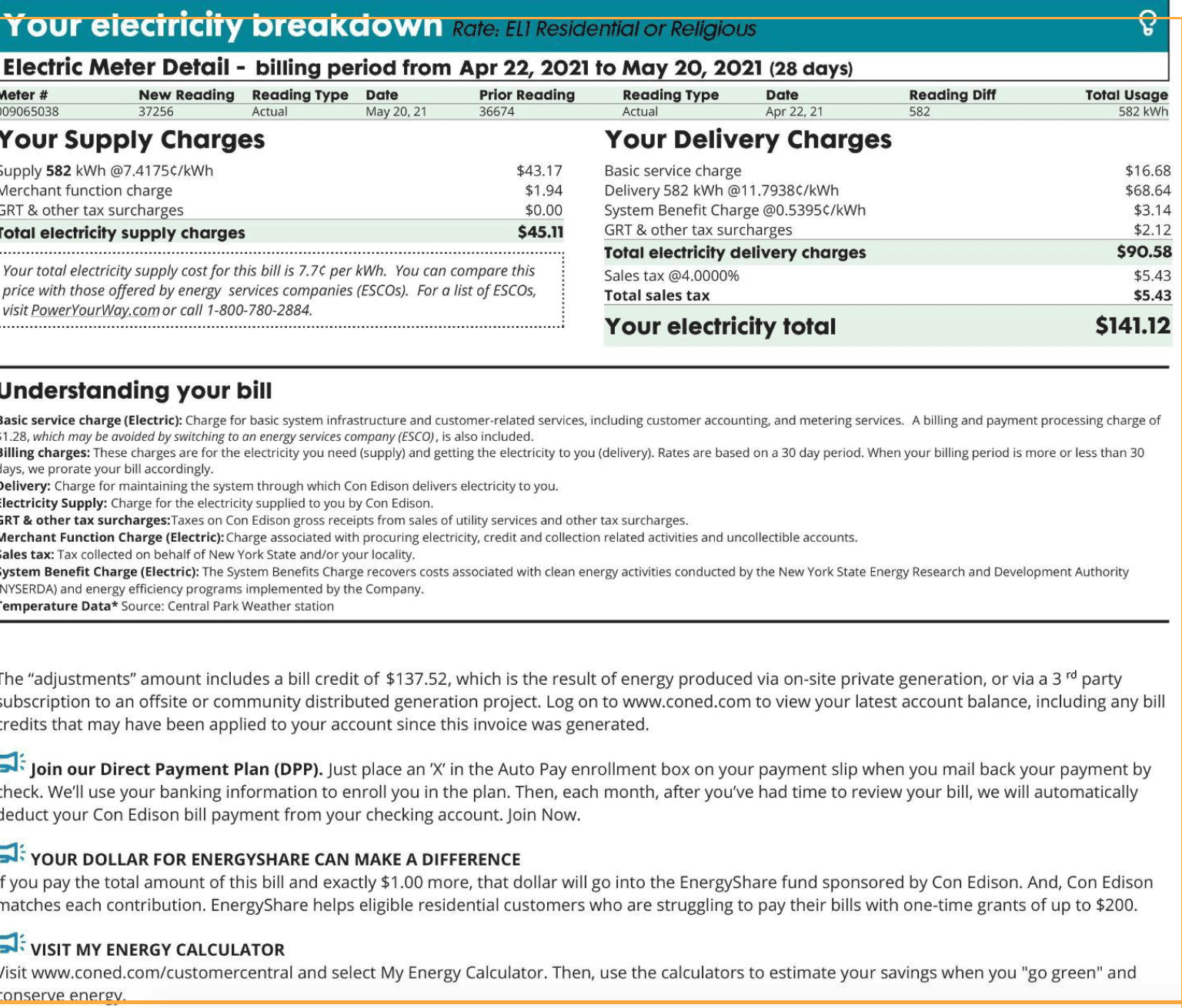

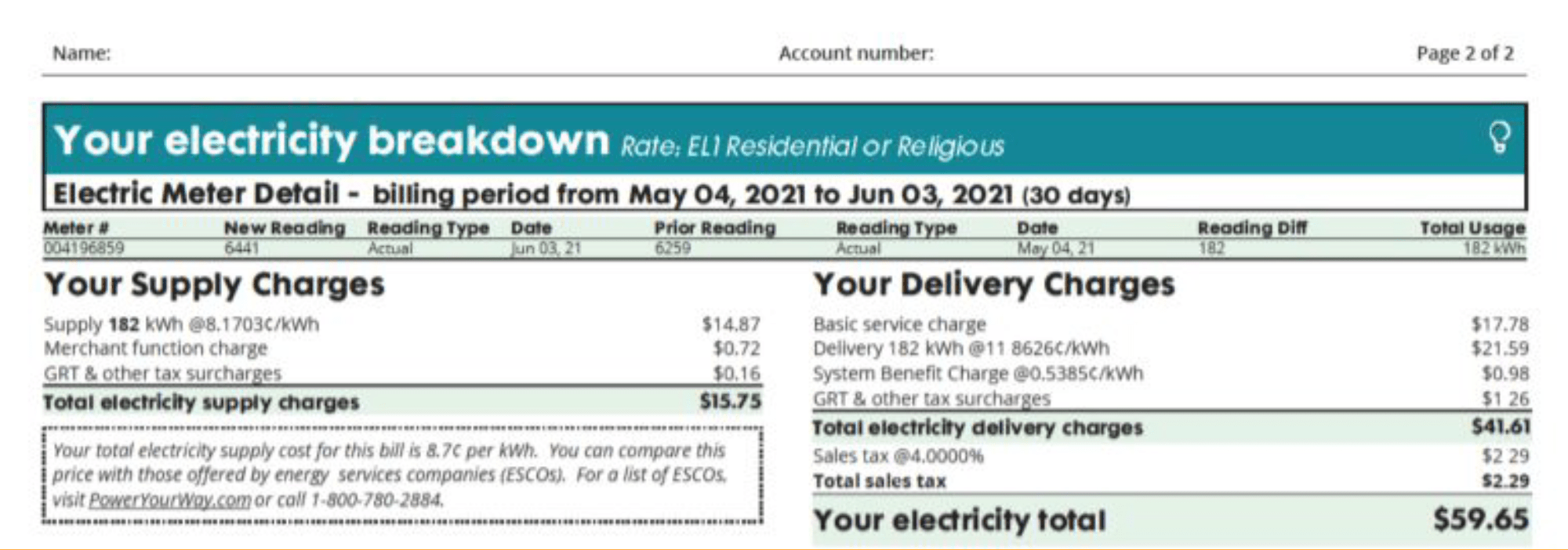

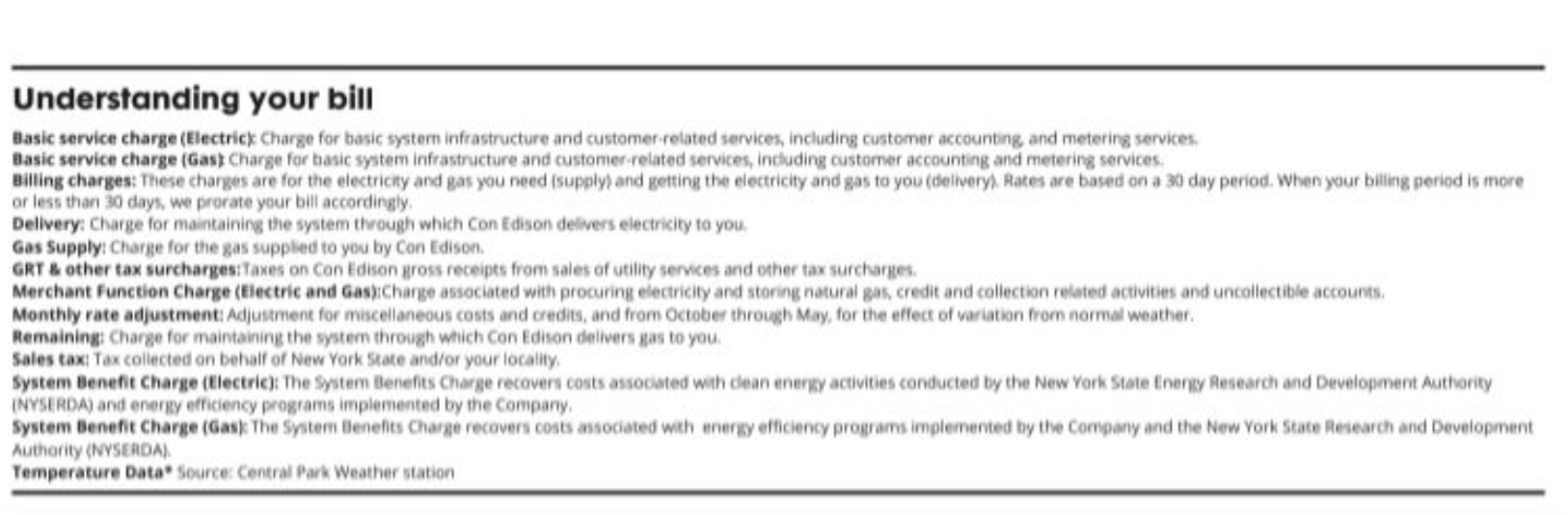

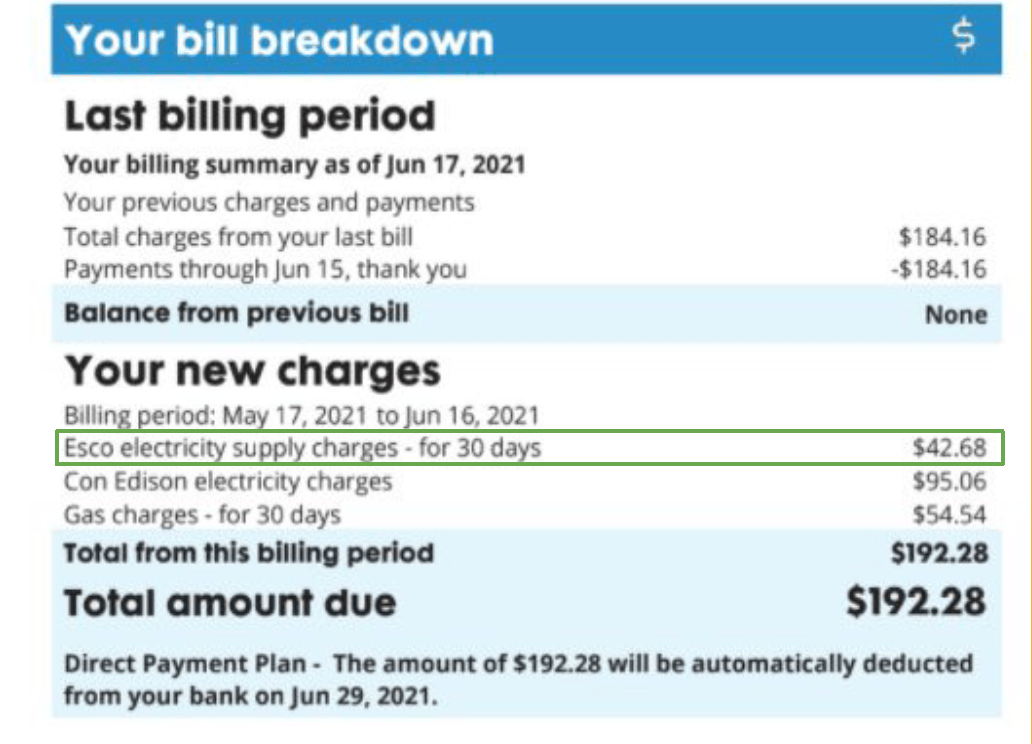

Second, don’t be discouraged. The federal government is only one source of support for energy improvements, and there are lots of others. Programs like NYSERDA’s Clean Heat, Comfort Home, and EmPower+ provide rebates for heat pumps, insulation, weatherization, and other home energy improvements. Utilities such as Con Edison and NYSEG also offer incentives for equipment upgrades, smart thermostats, and weatherization. Finally, remember that many home energy improvements can make economic sense even without incentives. As electricity rates rise and as the cost of technology comes down, solar panels, clean heating and cooling systems, and EVs will remain attractive options for many consumers.

Third, ask us for help. Our team is here to help you take the next step and make the most of these opportunities while they’re still available. We know the technologies, we understand the incentives, we have extensive relationships with contractors, we have deep experience supporting homeowners and businesses on their clean energy journey, and our services are free to residents! Reach out to Sustainable Westchester HERE.